HYPERNATIONALISM AND HYSTERIA CAUSED THE REKO DIQ DISPUTE. NOW BRACE YOURSELVES FOR THE IMPACT.

by Feisal Naqvi

Shah Marai—AFP

Shah Marai—AFP

Unless Pakistan manages to somehow reach a settlement in the Reko Diq copper mine case, it may well get poorer by at least $10 billion.

While Prime Minister Nawaz Sharif’s government is finally beginning to realize just how much trouble it is in with the international arbitrations over Reko Diq and may perhaps be inclined to settle, political and media opposition to any sort of settlement has already started. Pakistan is therefore stuck between two equally unpalatable options. If it chooses to settle, the domestic blowback could be devastating. If it doesn’t, adverse arbitration results will be a significant shock to the cash-strapped country.

If Pakistan chooses not to settle, its only option will be to refuse acknowledging its liability and joining Argentina as an outlaw state. That may win Pakistan temporary respite. But like Argentina, Pakistan will then face death (or at least financial ruin) by a thousand cuts.

The basic facts about the Reko Diq case are not in dispute.

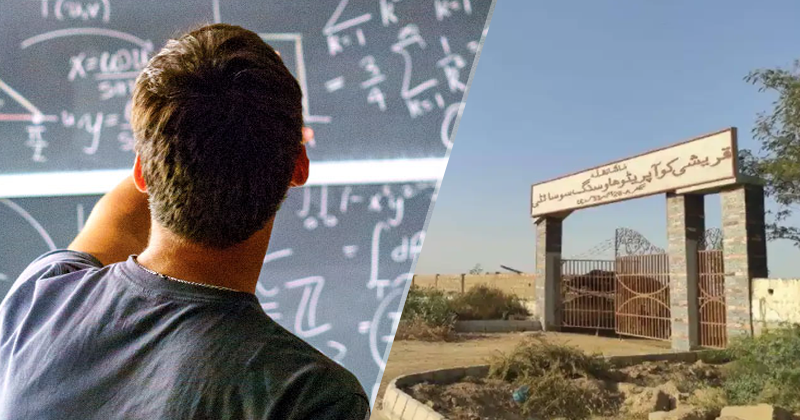

In 1993, the Balochistan Development Authority entered into a joint venture with BHP Minerals, a Delaware-incorporated company, to mine copper in Balochistan province. BHP was given exclusive rights to prospect in certain areas, and the Balochistan Development Authority the option to take a 25-percent interest in any commercial development arising out of BHP’s exploration, funded entirely by BHP.

The 1993 agreement also committed that Balochistan would relax certain requirements under the Balochistan Mining Rules, 1970, such as those pertaining to the maximum area for which prospecting licenses could be granted. (The Balochistan government granted the relaxations through its omnibus order of Jan. 20, 1994.)

In March 2000, the three parties—BHP, the Balochistan Development Authority, and the Balochistan government—signed an addendum to the seven-year-old agreement, ratifying everything done by the Balochistan Development Authority up until that date and making certain amendments to the original agreement. About a month later, BHP entered into an agreement with Tethyan Copper Company, a joint venture between two mining giants, Chile’s Antofagasta and Canada’s Barrick Gold. The transfer of BHP’s 75-percent stake to Tethyan was acknowledged and confirmed through a 2006 agreement signed with the Balochistan governor.

Between 2006 and 2011, Tethyan says it invested about $220 million in Reko Diq. During this time, it made a discovery of commercial grade copper. The value of this discovery ranges between $30 billion and $50 billion—the numbers vary, in part, due to different estimates of copper futures. (Estimates claiming Reko Diq’s worth in the trillions tend to confuse the amount of copper in the ground with the amount that is commercially recoverable.)

In 2010 and 2011, journalist Shaheen Sehbai authored a series of articles in which he repeatedly claimed that Pakistan’s “national interest” was being compromised because national assets worth “trillions” were being sold to foreigners for a song. The articles contained a number of allegations from unidentified sources as well as from sources subsequently identified as direct competitors of Tethyan. However, such journalistic quibbles were swept aside when Pakistan’s Supreme Court took cognizance of the matter.

In 2013, the Supreme Court held that since the original 1993 agreement was void, all subsequent agreements between Balochistan and Tethyan were also void. The court said the Balochistan Development Authority was never competent to have entered into the 1993 agreement on behalf of the Balochistan government. It also said that the various relaxations permitted by Balochistan to Tethyan were not legal because the provincial government had exercised its power to relax the rules in an illegal way: through blanket notification rather than individual, reasoned orders detailing why each departure from the rules was necessary.

By the time the Supreme Court issued its decision, Tethyan had already initiated international arbitration at two different forums: contractual arbitration under the rules of the International Chamber of Commerce, and treaty-based arbitration under the rules of the International Center for Settlement of Investment Disputes (ICSID).

Within the Pakistani establishment, there have been two types of broad responses to the proceedings initiated by Tethyan: nave and realist.

The nave response is that Pakistan has nothing to fear because the original 1993 agreement was governed by Pakistani law and that has already been definitively examined by our own Supreme Court. The nave approach further believes that the 1993 deal was so one-sided that any objective tribunal would conclude that our Supreme Court acted properly. By comparison, the realist approach argues that while Tethyan may have good reason to feel aggrieved, Pakistan has nothing to fear from international tribunals; that, as a sovereign state, it is “judgment proof.” Unfortunately, both responses are misconceived.

The nave response is legally misconceived because even when an international tribunal is bound to apply Pakistani law, it is not obligated to accept the opinion of the Supreme Court of Pakistan as binding. Indeed, the International Chamber of Commerce tribunal dealing with the Reko Diq dispute has already ruled that it is not bound by what the Supreme Court thinks and that it will reexamine, from scratch, the validity of what happened to the international investors, Tethyan. More importantly, the ICSID tribunal is not bound by Pakistani law at all. Instead, it will apply what can best be referred to as an international common law of investor-state relations.

The nave response is equally mistaken when it comes to the optics of what happened. There is no dispute that the 1993 agreement compares poorly to the 2008 Qara Zaghan goldmine deal under which the Afghan government is to receive 26-percent royalty. At the same time, the international consensus seems to be that Balochistan did well for itself under the 1993 agreement by locking up a 25-percent equity share, free and free of risk. For example, a senior consultant at the U.S.-based Copper Research Group was quoted by Reuters as saying that the terms of the 1993 agreement were “extremely generous” in favor of Balochistan and “not normal.”

For many observers, the relative generosity (or not) of the 1993 agreement is irrelevant. They argue that the Balochistan government signed a deal and is now trying to weasel out of it. They are willing to concede that an agreement can be set aside if Pakistan can show that the agreement was procured through fraud or corruption. But no tangible evidence of corruption or fraud has been produced by Pakistan so far in the international proceedings. In fact, as per unconfirmed reports, the International Chamber of Commerce tribunal hearing the Reko Diq dispute actually barred Pakistan from questioning a witness regarding allegations of corruption because there was no foundation for such a question, either in Pakistan’s written pleadings or in the evidence presented by witnesses.

Even otherwise, the tribunals hearing the Reko Diq dispute are likely to have very little sympathy for the distinction drawn by the Supreme Court of Pakistan between the Balochistan Development Authority and the Balochistan government. Rightly or wrongly, international arbitration law is very clear on the point that it is not an investor’s job to ensure that internal government processes have been complied with. If the Balochistan Development Authority was not legally authorized to represent the Balochistan government, then the consequences have to be borne by the Balochistan government: an investor cannot be made liable for a state’s own incompetence. Similarly, if the governor of Balochistan did not exercise his powers of relaxation in the correct way, the consequences have to fall on him—not on the investor.

The realist approach is equally misconceived because it wrongly assumes that defaulting on an international arbitration ruling is like defaulting on a sovereign-debt obligation, i.e., it’s no big deal. Unfortunately for Pakistan, the reality is far different.

A sovereign-debt obligation, like with Pakistan’s recent Eurobond issue, is where a state borrows money from the general public in exchange for a promise to pay. As many people have found out over the decades, when a sovereign defaults there is normally little that a bondholder can do. This fact became clear during the sovereign-debt crises of the 1980s when various Latin American countries happily defaulted without significant penalty. As the bondholders then learned, there is no universal legal regime which applies to the enforcement of sovereign-debt obligations. By comparison, the enforcement of international arbitral awards is very different from the enforcement of sovereign-debt obligations. There are specific, broadly accepted international legal regimes governing the enforcement of these awards, both generally and with respect to ICSID awards. And Pakistan has both signed and ratified those regimes.

In the case of normal international arbitration awards, their recognition and enforcement is governed by the New York Arbitration Convention of 1958. Under that treaty, all signatory countries must enforce international arbitration awards with limited exceptions. In the case of ICSID awards, even those limited exceptions are not available. An ICSID award can be challenged before a special three-member annulment committee, but if that challenge fails, there is no legal recourse left. Under the ICSID Convention of 1966, every signatory state must enforce an ICSID award as if it were a judgment of that very country’s own courts. Indeed, the purpose behind the ICSID Convention was to make sure that arbitration judgments against sovereign states can be easily enforced.

In practical terms, once an ICSID award has become final, that award can be taken to most countries of the world and enforced without any further discussion or debate. The defaulting state cannot then challenge the validity of the award. All it can do is to plead sovereign immunity. And even then, sovereign immunity does not protect state assets which are commercial. This means that Pakistan’s Embassy in Washington, D.C., cannot be attached and sold to pay for Pakistan’s debts. But Pakistan International Airlines’ Roosevelt Hotel in Manhattan most certainly can be attached and sold.

A state which loses an ICSID claim has two options: pay up without much negotiation or take the Argentina Option.

In 2002, Argentina’s currency went into freefall. During the resulting crisis, Argentina froze foreign currency accounts and assets. That in turn led to a wave of litigation. When the results came against Argentina, it refused to pay up. Instead, it launched a scorched-earth counteroffensive in which it challenged each and every case in each and every jurisdiction. Until recently, Argentina’s results had been impressive. Over the past decade, Argentina has failed to make any payment except on its own terms. At the same time, the cost to Argentina has turned increasingly steep. Argentina has become increasingly isolated from the international capital markets. It has also had to face international embarrassment caused by incidents such as the one in 2012 when a Ghanaian court detained an Argentine Navy training ship.

Courtesy of Tethyan

Courtesy of Tethyan

The final straw appears to have been provided by two judgments last June by the U.S. Supreme Court. One judgment refused to hear an appeal against a lower-court decision holding that Argentina had acted illegally. The second held that American banks could be directed to divulge details of all commercial assets held by Argentina. According to one expert quoted by the BBC, “This realistically is the end of the road for Argentina’s decade-long fight.”

What then about Pakistan’s political capital? After all, as the realists like to point out, our country occupies a unique geopolitical role so much so, that the U.S. would never let Pakistan be bankrupted by international investors.

It cannot be disputed that Pakistan has long perfected the art of negotiating with a gun to its own head. However, even if it is assumed that Western countries would be keen to protect Pakistan, their ability to do so will be limited. For example, the U.S. government supported the position of Argentina before the U.S. Supreme Court (and lost 7-1). That decision is now no longer open to examination and, therefore, Pakistan would not be able to use some of the delaying tactics adopted by Argentina.

In the end though, the primary factor determining how the Pakistani government is going to deal with the Reko Diq dispute is likely to be domestic politics. Imran Khan’s Pakistan Tehreek-e-Insaf has already started a social media campaign insinuating that the ruling Pakistan Muslim League (Nawaz) is selling out on Reko Diq. The chief minister of Balochistan has also held a press conference in which he has strongly reiterated his opposition to any settlement. And talk show hosts Mubasher Lucman and Dr. Shahid Masood have aired programs accusing all and sundry of having accepted millions in exchange for a deal on Reko Diq.

In these circumstances, the chances of a negotiated settlement look slim. The Pakistani government is politically hamstrung and cannot agree except on terms which are completely one-sided in its favor. On the other side, the claimants have little incentive to reach a settlement. They have already spent millions on legal fees and are eyeing a jackpot of more than $10 billion. Even if they cannot be bothered to spend more time running after the Pakistani government to execute an award, they can sell their interest to “vulture investors” who specialize in such recoveries.

Tethyan is also reluctant to make any deal with the Pakistani government because, as it rightly notes, any such agreement would immediately be challenged before the Supreme Court of Pakistan. Not surprisingly, the Pakistani government is trying to avoid the inevitable by kicking the can down the road. It has asked the ICSID tribunal hearing the matter to divide the remaining case into two stages. It could therefore be three to four years before any final award shows up.

One source familiar with the matter explained the government’s strategy using a joke popular among bureaucrats: The king of a country hears that the ruler of a neighboring country is the proud possessor of a talking horse. The king immediately summons his senior vizier and demands that his favorite horse be taught to converse. The vizier tells the king that his demand is impossible, whereupon the king has the vizier beheaded. The king then turns to the second-most senior vizier and asks him if he can teach the horse to talk. The newly promoted vizier bows deeply and says that of course he can, but that he will require two years to perform this task. After the king leaves the darbar, other courtiers ask the vizier why he has agreed to the impossible. The vizier points out to them that two years is a long time. During this time, he says, the king could die, he himself could die, and finally, perhaps, the horse might actually start talking.

If Pakistan does not settle, the awards in Reko Diq will show up sometime between two and four years from now. Let’s hope the horse learns to talk.

Naqvi is a senior lawyer at the Supreme Court of Pakistan. From our Jan. 10-17, 2015, issue.

http://newsweekpakistan.com/pakistans-10-billion-problem/

by Feisal Naqvi

Unless Pakistan manages to somehow reach a settlement in the Reko Diq copper mine case, it may well get poorer by at least $10 billion.

While Prime Minister Nawaz Sharif’s government is finally beginning to realize just how much trouble it is in with the international arbitrations over Reko Diq and may perhaps be inclined to settle, political and media opposition to any sort of settlement has already started. Pakistan is therefore stuck between two equally unpalatable options. If it chooses to settle, the domestic blowback could be devastating. If it doesn’t, adverse arbitration results will be a significant shock to the cash-strapped country.

If Pakistan chooses not to settle, its only option will be to refuse acknowledging its liability and joining Argentina as an outlaw state. That may win Pakistan temporary respite. But like Argentina, Pakistan will then face death (or at least financial ruin) by a thousand cuts.

The basic facts about the Reko Diq case are not in dispute.

In 1993, the Balochistan Development Authority entered into a joint venture with BHP Minerals, a Delaware-incorporated company, to mine copper in Balochistan province. BHP was given exclusive rights to prospect in certain areas, and the Balochistan Development Authority the option to take a 25-percent interest in any commercial development arising out of BHP’s exploration, funded entirely by BHP.

The 1993 agreement also committed that Balochistan would relax certain requirements under the Balochistan Mining Rules, 1970, such as those pertaining to the maximum area for which prospecting licenses could be granted. (The Balochistan government granted the relaxations through its omnibus order of Jan. 20, 1994.)

In March 2000, the three parties—BHP, the Balochistan Development Authority, and the Balochistan government—signed an addendum to the seven-year-old agreement, ratifying everything done by the Balochistan Development Authority up until that date and making certain amendments to the original agreement. About a month later, BHP entered into an agreement with Tethyan Copper Company, a joint venture between two mining giants, Chile’s Antofagasta and Canada’s Barrick Gold. The transfer of BHP’s 75-percent stake to Tethyan was acknowledged and confirmed through a 2006 agreement signed with the Balochistan governor.

Between 2006 and 2011, Tethyan says it invested about $220 million in Reko Diq. During this time, it made a discovery of commercial grade copper. The value of this discovery ranges between $30 billion and $50 billion—the numbers vary, in part, due to different estimates of copper futures. (Estimates claiming Reko Diq’s worth in the trillions tend to confuse the amount of copper in the ground with the amount that is commercially recoverable.)

In 2010 and 2011, journalist Shaheen Sehbai authored a series of articles in which he repeatedly claimed that Pakistan’s “national interest” was being compromised because national assets worth “trillions” were being sold to foreigners for a song. The articles contained a number of allegations from unidentified sources as well as from sources subsequently identified as direct competitors of Tethyan. However, such journalistic quibbles were swept aside when Pakistan’s Supreme Court took cognizance of the matter.

In 2013, the Supreme Court held that since the original 1993 agreement was void, all subsequent agreements between Balochistan and Tethyan were also void. The court said the Balochistan Development Authority was never competent to have entered into the 1993 agreement on behalf of the Balochistan government. It also said that the various relaxations permitted by Balochistan to Tethyan were not legal because the provincial government had exercised its power to relax the rules in an illegal way: through blanket notification rather than individual, reasoned orders detailing why each departure from the rules was necessary.

By the time the Supreme Court issued its decision, Tethyan had already initiated international arbitration at two different forums: contractual arbitration under the rules of the International Chamber of Commerce, and treaty-based arbitration under the rules of the International Center for Settlement of Investment Disputes (ICSID).

Within the Pakistani establishment, there have been two types of broad responses to the proceedings initiated by Tethyan: nave and realist.

The nave response is that Pakistan has nothing to fear because the original 1993 agreement was governed by Pakistani law and that has already been definitively examined by our own Supreme Court. The nave approach further believes that the 1993 deal was so one-sided that any objective tribunal would conclude that our Supreme Court acted properly. By comparison, the realist approach argues that while Tethyan may have good reason to feel aggrieved, Pakistan has nothing to fear from international tribunals; that, as a sovereign state, it is “judgment proof.” Unfortunately, both responses are misconceived.

The nave response is legally misconceived because even when an international tribunal is bound to apply Pakistani law, it is not obligated to accept the opinion of the Supreme Court of Pakistan as binding. Indeed, the International Chamber of Commerce tribunal dealing with the Reko Diq dispute has already ruled that it is not bound by what the Supreme Court thinks and that it will reexamine, from scratch, the validity of what happened to the international investors, Tethyan. More importantly, the ICSID tribunal is not bound by Pakistani law at all. Instead, it will apply what can best be referred to as an international common law of investor-state relations.

The nave response is equally mistaken when it comes to the optics of what happened. There is no dispute that the 1993 agreement compares poorly to the 2008 Qara Zaghan goldmine deal under which the Afghan government is to receive 26-percent royalty. At the same time, the international consensus seems to be that Balochistan did well for itself under the 1993 agreement by locking up a 25-percent equity share, free and free of risk. For example, a senior consultant at the U.S.-based Copper Research Group was quoted by Reuters as saying that the terms of the 1993 agreement were “extremely generous” in favor of Balochistan and “not normal.”

For many observers, the relative generosity (or not) of the 1993 agreement is irrelevant. They argue that the Balochistan government signed a deal and is now trying to weasel out of it. They are willing to concede that an agreement can be set aside if Pakistan can show that the agreement was procured through fraud or corruption. But no tangible evidence of corruption or fraud has been produced by Pakistan so far in the international proceedings. In fact, as per unconfirmed reports, the International Chamber of Commerce tribunal hearing the Reko Diq dispute actually barred Pakistan from questioning a witness regarding allegations of corruption because there was no foundation for such a question, either in Pakistan’s written pleadings or in the evidence presented by witnesses.

Even otherwise, the tribunals hearing the Reko Diq dispute are likely to have very little sympathy for the distinction drawn by the Supreme Court of Pakistan between the Balochistan Development Authority and the Balochistan government. Rightly or wrongly, international arbitration law is very clear on the point that it is not an investor’s job to ensure that internal government processes have been complied with. If the Balochistan Development Authority was not legally authorized to represent the Balochistan government, then the consequences have to be borne by the Balochistan government: an investor cannot be made liable for a state’s own incompetence. Similarly, if the governor of Balochistan did not exercise his powers of relaxation in the correct way, the consequences have to fall on him—not on the investor.

The realist approach is equally misconceived because it wrongly assumes that defaulting on an international arbitration ruling is like defaulting on a sovereign-debt obligation, i.e., it’s no big deal. Unfortunately for Pakistan, the reality is far different.

A sovereign-debt obligation, like with Pakistan’s recent Eurobond issue, is where a state borrows money from the general public in exchange for a promise to pay. As many people have found out over the decades, when a sovereign defaults there is normally little that a bondholder can do. This fact became clear during the sovereign-debt crises of the 1980s when various Latin American countries happily defaulted without significant penalty. As the bondholders then learned, there is no universal legal regime which applies to the enforcement of sovereign-debt obligations. By comparison, the enforcement of international arbitral awards is very different from the enforcement of sovereign-debt obligations. There are specific, broadly accepted international legal regimes governing the enforcement of these awards, both generally and with respect to ICSID awards. And Pakistan has both signed and ratified those regimes.

In the case of normal international arbitration awards, their recognition and enforcement is governed by the New York Arbitration Convention of 1958. Under that treaty, all signatory countries must enforce international arbitration awards with limited exceptions. In the case of ICSID awards, even those limited exceptions are not available. An ICSID award can be challenged before a special three-member annulment committee, but if that challenge fails, there is no legal recourse left. Under the ICSID Convention of 1966, every signatory state must enforce an ICSID award as if it were a judgment of that very country’s own courts. Indeed, the purpose behind the ICSID Convention was to make sure that arbitration judgments against sovereign states can be easily enforced.

In practical terms, once an ICSID award has become final, that award can be taken to most countries of the world and enforced without any further discussion or debate. The defaulting state cannot then challenge the validity of the award. All it can do is to plead sovereign immunity. And even then, sovereign immunity does not protect state assets which are commercial. This means that Pakistan’s Embassy in Washington, D.C., cannot be attached and sold to pay for Pakistan’s debts. But Pakistan International Airlines’ Roosevelt Hotel in Manhattan most certainly can be attached and sold.

A state which loses an ICSID claim has two options: pay up without much negotiation or take the Argentina Option.

In 2002, Argentina’s currency went into freefall. During the resulting crisis, Argentina froze foreign currency accounts and assets. That in turn led to a wave of litigation. When the results came against Argentina, it refused to pay up. Instead, it launched a scorched-earth counteroffensive in which it challenged each and every case in each and every jurisdiction. Until recently, Argentina’s results had been impressive. Over the past decade, Argentina has failed to make any payment except on its own terms. At the same time, the cost to Argentina has turned increasingly steep. Argentina has become increasingly isolated from the international capital markets. It has also had to face international embarrassment caused by incidents such as the one in 2012 when a Ghanaian court detained an Argentine Navy training ship.

The final straw appears to have been provided by two judgments last June by the U.S. Supreme Court. One judgment refused to hear an appeal against a lower-court decision holding that Argentina had acted illegally. The second held that American banks could be directed to divulge details of all commercial assets held by Argentina. According to one expert quoted by the BBC, “This realistically is the end of the road for Argentina’s decade-long fight.”

What then about Pakistan’s political capital? After all, as the realists like to point out, our country occupies a unique geopolitical role so much so, that the U.S. would never let Pakistan be bankrupted by international investors.

It cannot be disputed that Pakistan has long perfected the art of negotiating with a gun to its own head. However, even if it is assumed that Western countries would be keen to protect Pakistan, their ability to do so will be limited. For example, the U.S. government supported the position of Argentina before the U.S. Supreme Court (and lost 7-1). That decision is now no longer open to examination and, therefore, Pakistan would not be able to use some of the delaying tactics adopted by Argentina.

In the end though, the primary factor determining how the Pakistani government is going to deal with the Reko Diq dispute is likely to be domestic politics. Imran Khan’s Pakistan Tehreek-e-Insaf has already started a social media campaign insinuating that the ruling Pakistan Muslim League (Nawaz) is selling out on Reko Diq. The chief minister of Balochistan has also held a press conference in which he has strongly reiterated his opposition to any settlement. And talk show hosts Mubasher Lucman and Dr. Shahid Masood have aired programs accusing all and sundry of having accepted millions in exchange for a deal on Reko Diq.

In these circumstances, the chances of a negotiated settlement look slim. The Pakistani government is politically hamstrung and cannot agree except on terms which are completely one-sided in its favor. On the other side, the claimants have little incentive to reach a settlement. They have already spent millions on legal fees and are eyeing a jackpot of more than $10 billion. Even if they cannot be bothered to spend more time running after the Pakistani government to execute an award, they can sell their interest to “vulture investors” who specialize in such recoveries.

Tethyan is also reluctant to make any deal with the Pakistani government because, as it rightly notes, any such agreement would immediately be challenged before the Supreme Court of Pakistan. Not surprisingly, the Pakistani government is trying to avoid the inevitable by kicking the can down the road. It has asked the ICSID tribunal hearing the matter to divide the remaining case into two stages. It could therefore be three to four years before any final award shows up.

One source familiar with the matter explained the government’s strategy using a joke popular among bureaucrats: The king of a country hears that the ruler of a neighboring country is the proud possessor of a talking horse. The king immediately summons his senior vizier and demands that his favorite horse be taught to converse. The vizier tells the king that his demand is impossible, whereupon the king has the vizier beheaded. The king then turns to the second-most senior vizier and asks him if he can teach the horse to talk. The newly promoted vizier bows deeply and says that of course he can, but that he will require two years to perform this task. After the king leaves the darbar, other courtiers ask the vizier why he has agreed to the impossible. The vizier points out to them that two years is a long time. During this time, he says, the king could die, he himself could die, and finally, perhaps, the horse might actually start talking.

If Pakistan does not settle, the awards in Reko Diq will show up sometime between two and four years from now. Let’s hope the horse learns to talk.

Naqvi is a senior lawyer at the Supreme Court of Pakistan. From our Jan. 10-17, 2015, issue.

http://newsweekpakistan.com/pakistans-10-billion-problem/