The Economic Collapse

Aug 18, 2011

If you thought that 2011 was a bad year for the world economy, just wait until you see what happens in 2012. The U.S. and Europe are both dealing with unprecedented debt problems, the financial markets are flailing about wildly, austerity programs are being implemented all over the globe, prices on basics such as food are soaring and a lot of consumers are flat out scared right now. Many analysts now fear that a perfect storm could be brewing and that we could actually be headed for an economic apocalypse in 2012. Hopefully that will not happen. Hopefully our leaders can keep the global economy from completely falling apart. But right now, things dont look good. After a period of relative stability, things are starting to become unglued once again. The next major financial panic could literally happen at any time. Sadly, if we do see an economic apocalypse in 2012, it wont be the wealthy that suffer the most. It will be the poor, the unemployed, the homeless and the hungry that feel the most pain.

The following are 20 signs that we could be headed for an economic apocalypse in 2012.

#1 Back in 2008 we saw major rioting around the world due to soaring food prices, and now global food prices are on the rise again. Global food prices in July were 33 percent higherthan they were one year ago. Price increases for staples such as maize (up 84 percent), sugar (up 62 percent) and wheat (up 55 percent) are absolutely devastating poverty-stricken communities all over the planet. For example, one expert is warning that 800,000 childrenliving in the Horn of Africa could die during this current famine.

#2 The producer price index in the U.S. has increased at an annual rate of at least 7.0% for the last three months in a row. We are starting to see huge price increases all over the place. For example, Starbucks recently jacked up the price of a bag of coffee by 17 percent. If inflation keeps accelerating like this we could be facing some very serious problems by the time 2012 rolls around.

#3 The U.S. Misery Index (unemployment plus inflation) recently hit a 28 year high and many believe that it is going to go much, much higher.

#4 Jared Bernstein, the former chief economist for Vice President Joe Biden, says that the unemployment rate in this country will not go below 8% before the 2012 election. In fact, Bernstein says that the most optimistic forecast would be for about eight-and-a-half percent.

#5 Working class jobs in the United States continue to disappear at an alarming rate. Back in 1967, 97 percent of men with a high school degree between the ages of 30 and 50 had jobs. Today, that figure is 76 percent.

#6 There are all kinds of indications that U.S. economic growth is about to slow down even further. For example, pre-orders for Christmas toys from China are way down this year.

#7 One recent survey found that 9 out of 10 U.S. workers do not expect their wages to keep up with the rising cost of basics such as food and gasoline over the next year.

#8 U.S. consumer confidence is now at its lowest level in 30 years.

#9 Today, an all-time record 45.8 million Americans are on food stamps. It is almost inconceivable that the largest economy on earth could have so many people dependent on the government for food.

#10 As the economy crumbles, we are also witnessing the fabric of society beginning to come apart. The recent flash mob crimes that we are starting to see all over America are just one example of this.

#11 Some desperate Americans are already stealing anything that they can get their hands on. For example, according to the American Kennel Club, dog thefts are up 32 percent this year.

#12 Small businesses all over the United States are having a really difficult time getting loans right now. Perhaps if the Federal Reserve was not paying banks not to make loans things would be different.

#13 The U.S. national debt is like a giant boulder that our economy must constantly carry around on its back, and it is growing by billions of dollars every single day. Right now the debt of the federal government is $14,592,242,215,641.90. It has gone up by nearly 4 trillion dollars since Barack Obama took office. S&P has already stripped the U.S. of its AAA credit rating, and more downgrades are certain to come if the U.S. does not get its act together.

#14 Tensions between the United States and China are rising again. A new opinion piece on chinadaily.com is calling for the Chinese government to use its holdings of U.S. debt as a financial weapon against the United States if the U.S. follows through with a plan to sell more arms to Taiwan. The U.S. and China are the two biggest economies in the world, so any trouble between them would mean economic trouble for the rest of the globe as well.

#15 Most state and local governments in the U.S. are deep in debt and flat broke. Many of them are slashing jobs at a feverish pace. According to the Center on Budget and Policy Priorities, state and local governments have eliminated more than half a million jobs since August 2008. UBS Investment Research is projecting that state and local governments in the U.S. will cut450,000 more jobs by the end of 2012. How those jobs will be replaced is anyones guess.

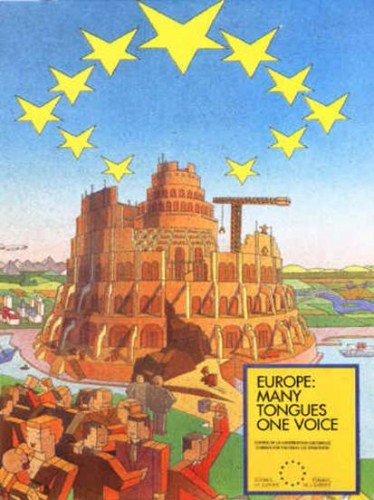

#16 The U.S. dollar continues to get weaker and weaker. This is renewing calls for a new global currency to be created to replace the U.S. dollar as the reserve currency of the world.

#17 The European sovereign debt crisis continues to get worse. Countries like Portugal, Italy and Greece are on the verge of an economic apocalypse. All of the financial problems in Europe are even beginning to affect the core European nations. For example, German industrial production declined by 1.1% in June. There are all kinds of signs that the economy of Europe is slowing down and is heading for a recession. French President Nicolas Sarkozy and German Chancellor Angela Merkel are proposing that a new economic government for Europe be set up to oversee this debt crisis, but nothing that the Europeans have tried so far has done much to solve things.

#18 The Federal Reserve is so desperate to bring some sort of stability to financial markets that it has stated that it will likely keep interest rates near zero all the way until mid-2013. The Federal Reserve is operating in panic mode almost constantly now and they are almost out of ammunition. So what is going to happen when the real trouble starts?

#19 Central banks around the world certainly seem to be preparing for something. According to the World Gold Council, central banks around the globe purchased more gold during the first half of 2011 than they did all of last year.

#20 Often perception very much influences reality. One recent survey found that 48 percent of Americans believe that it is likely that another great Depression will begin within the next 12 months. If people expect that a depression is coming and they quit spending money that actually increases the chance that an economic downturn will occur.

There is already a tremendous amount of economic pain on the streets of America, but unfortunately it looks like things may get even worse in 2012.

The once great economic machine that was handed down to us by our forefathers is falling to pieces all around us and we are in debt up to our eyeballs. The consequences of our bad economic decisions are hurting some of the most vulnerable members of our society the most.

As the following video shows, large numbers of formerly middle class Americans are now living in their cars or sleeping in the streets.

http://youtu.be/ICx3AfSlc-w

It is a crying shame what is happening out there on the streets of America today.

Please say a prayer for all of those that are sleeping in cars or tents or under bridges tonight.

Soon even more Americans will be joining them.

Link: http://www.infowars.com/20-signs-that-the-world-could-be-headed-for-an-economic-apocalypse-in-2012/

Aug 18, 2011

If you thought that 2011 was a bad year for the world economy, just wait until you see what happens in 2012. The U.S. and Europe are both dealing with unprecedented debt problems, the financial markets are flailing about wildly, austerity programs are being implemented all over the globe, prices on basics such as food are soaring and a lot of consumers are flat out scared right now. Many analysts now fear that a perfect storm could be brewing and that we could actually be headed for an economic apocalypse in 2012. Hopefully that will not happen. Hopefully our leaders can keep the global economy from completely falling apart. But right now, things dont look good. After a period of relative stability, things are starting to become unglued once again. The next major financial panic could literally happen at any time. Sadly, if we do see an economic apocalypse in 2012, it wont be the wealthy that suffer the most. It will be the poor, the unemployed, the homeless and the hungry that feel the most pain.

The following are 20 signs that we could be headed for an economic apocalypse in 2012.

#1 Back in 2008 we saw major rioting around the world due to soaring food prices, and now global food prices are on the rise again. Global food prices in July were 33 percent higherthan they were one year ago. Price increases for staples such as maize (up 84 percent), sugar (up 62 percent) and wheat (up 55 percent) are absolutely devastating poverty-stricken communities all over the planet. For example, one expert is warning that 800,000 childrenliving in the Horn of Africa could die during this current famine.

#2 The producer price index in the U.S. has increased at an annual rate of at least 7.0% for the last three months in a row. We are starting to see huge price increases all over the place. For example, Starbucks recently jacked up the price of a bag of coffee by 17 percent. If inflation keeps accelerating like this we could be facing some very serious problems by the time 2012 rolls around.

#3 The U.S. Misery Index (unemployment plus inflation) recently hit a 28 year high and many believe that it is going to go much, much higher.

#4 Jared Bernstein, the former chief economist for Vice President Joe Biden, says that the unemployment rate in this country will not go below 8% before the 2012 election. In fact, Bernstein says that the most optimistic forecast would be for about eight-and-a-half percent.

#5 Working class jobs in the United States continue to disappear at an alarming rate. Back in 1967, 97 percent of men with a high school degree between the ages of 30 and 50 had jobs. Today, that figure is 76 percent.

#6 There are all kinds of indications that U.S. economic growth is about to slow down even further. For example, pre-orders for Christmas toys from China are way down this year.

#7 One recent survey found that 9 out of 10 U.S. workers do not expect their wages to keep up with the rising cost of basics such as food and gasoline over the next year.

#8 U.S. consumer confidence is now at its lowest level in 30 years.

#9 Today, an all-time record 45.8 million Americans are on food stamps. It is almost inconceivable that the largest economy on earth could have so many people dependent on the government for food.

#10 As the economy crumbles, we are also witnessing the fabric of society beginning to come apart. The recent flash mob crimes that we are starting to see all over America are just one example of this.

#11 Some desperate Americans are already stealing anything that they can get their hands on. For example, according to the American Kennel Club, dog thefts are up 32 percent this year.

#12 Small businesses all over the United States are having a really difficult time getting loans right now. Perhaps if the Federal Reserve was not paying banks not to make loans things would be different.

#13 The U.S. national debt is like a giant boulder that our economy must constantly carry around on its back, and it is growing by billions of dollars every single day. Right now the debt of the federal government is $14,592,242,215,641.90. It has gone up by nearly 4 trillion dollars since Barack Obama took office. S&P has already stripped the U.S. of its AAA credit rating, and more downgrades are certain to come if the U.S. does not get its act together.

#14 Tensions between the United States and China are rising again. A new opinion piece on chinadaily.com is calling for the Chinese government to use its holdings of U.S. debt as a financial weapon against the United States if the U.S. follows through with a plan to sell more arms to Taiwan. The U.S. and China are the two biggest economies in the world, so any trouble between them would mean economic trouble for the rest of the globe as well.

#15 Most state and local governments in the U.S. are deep in debt and flat broke. Many of them are slashing jobs at a feverish pace. According to the Center on Budget and Policy Priorities, state and local governments have eliminated more than half a million jobs since August 2008. UBS Investment Research is projecting that state and local governments in the U.S. will cut450,000 more jobs by the end of 2012. How those jobs will be replaced is anyones guess.

#16 The U.S. dollar continues to get weaker and weaker. This is renewing calls for a new global currency to be created to replace the U.S. dollar as the reserve currency of the world.

#17 The European sovereign debt crisis continues to get worse. Countries like Portugal, Italy and Greece are on the verge of an economic apocalypse. All of the financial problems in Europe are even beginning to affect the core European nations. For example, German industrial production declined by 1.1% in June. There are all kinds of signs that the economy of Europe is slowing down and is heading for a recession. French President Nicolas Sarkozy and German Chancellor Angela Merkel are proposing that a new economic government for Europe be set up to oversee this debt crisis, but nothing that the Europeans have tried so far has done much to solve things.

#18 The Federal Reserve is so desperate to bring some sort of stability to financial markets that it has stated that it will likely keep interest rates near zero all the way until mid-2013. The Federal Reserve is operating in panic mode almost constantly now and they are almost out of ammunition. So what is going to happen when the real trouble starts?

#19 Central banks around the world certainly seem to be preparing for something. According to the World Gold Council, central banks around the globe purchased more gold during the first half of 2011 than they did all of last year.

#20 Often perception very much influences reality. One recent survey found that 48 percent of Americans believe that it is likely that another great Depression will begin within the next 12 months. If people expect that a depression is coming and they quit spending money that actually increases the chance that an economic downturn will occur.

There is already a tremendous amount of economic pain on the streets of America, but unfortunately it looks like things may get even worse in 2012.

The once great economic machine that was handed down to us by our forefathers is falling to pieces all around us and we are in debt up to our eyeballs. The consequences of our bad economic decisions are hurting some of the most vulnerable members of our society the most.

As the following video shows, large numbers of formerly middle class Americans are now living in their cars or sleeping in the streets.

http://youtu.be/ICx3AfSlc-w

It is a crying shame what is happening out there on the streets of America today.

Please say a prayer for all of those that are sleeping in cars or tents or under bridges tonight.

Soon even more Americans will be joining them.

Link: http://www.infowars.com/20-signs-that-the-world-could-be-headed-for-an-economic-apocalypse-in-2012/